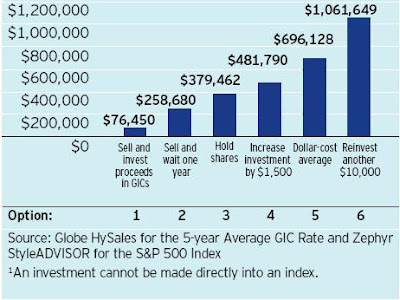

Hypothetical C$10,000 Investment

In the S&P 500 Index1

January 1, 1979 - October 3, 1974

How would you have reacted?

1 Sell your shares and put the proceeds into a Guaranteed Investment Certificate (GIC).

2 Sell your shares and wait one year before reinvesting.

3 Hold on to your shares (remain invested).

4 Increase your investment by $1,500.

5 Dollar-cost average $1,000 a year for the next 10 years.

6 Reinvest another $10,000.

Continue Reading to see which option outpreformed.

Committed investors should stay the course

When the market plunged in the ‘70s, savvy investors knew that the down times wouldn’t last forever. They looked beyond the loss to see an opportunity for long-term potential gains. While some investors jump at the first signs of trouble, others know they have time on their side. If you’re concerned about market volatility, seek the combined expertise of your advisor and the investment management of Invesco Trimark.

Growth of hypothetical C$ 10,000

Investment in the S&P500 index1

Dollar values from October 3, 1974(as at December 31 2007)

Following the 1973–74 downturn, the investments of dedicated investors increased

more than those who pulled their funds from the market.

Number of years to regain original C$ 10,000

Investment in the S&P 500 Index1

Years from market bottom of October 2, 1974

(as at December 21, 2007)

It took investors who remained committed to their longterm goals less time to recover their

investment than those who fled the stock market.

Globe HySales 5-year Average GIC rate is a calculated index, derived by using the month-end 5-year Trust Company GIC rate as provided by the Bank of Canada. The rate assumes monthly reinvestments of interest and capital and should not be considered as the actual return of an investment in a 5-year GIC. The information provided is general in nature and is provided with the understanding that it may not be relied upon as, nor considered to be, the rendering of tax, legal, accounting or professional advice. Readers should consult with their own accountants and/or lawyers for advice on the specific circumstances before taking any action.

Commissions, trailing commissions, management fees and expenses may all be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. Please read the prospectus before investing. Copies are available from your advisor or from Invesco Trimark.

* Invesco and all associated trademarks are trademarks of Invesco Holding Company Limited, used

under licence. Trimark and all associated trademarks are trademarks of Invesco Trimark Ltd.

© Invesco Trimark Ltd., 2008

ISSOIAE(08/08)